sales tax rate tucson az 85718

Use the physical address or the zip code. 930000 Last Sold Price.

2355 E Miraval Segundo Tucson Az 85718 Realtor Com

The estimated 2022 sales tax rate for 85718 is.

. The 2018 United States Supreme Court decision in South Dakota v. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Tucson Az 85718 currently has 147 tax liens available as of September 3.

Nearby homes similar to 5211 N Foothills Dr have recently sold between 460K to 1498K at an average of 305 per square foot. The arizona az state sales tax rate is currently 56. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

SOLD JUN 1 2022. Sales tax and use tax rate of zip code 85718 is located in tucson city pima county arizona state. The latest sales tax rates for cities in Arizona AZ state.

This includes the rates on the state county city and special levels. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. The Arizona state sales tax rate is 56 and the average AZ sales tax after local.

The minimum combined 2022 sales tax rate for Tucson Arizona is 87. Zip code 85718 is located in Tucson Arizona and has a. Rates include state county and city taxes.

Arizona Tax Rate Look Up Resource. 2020 rates included for use while preparing your income tax deduction. Higher sales tax than 70 of Arizona localities 22 lower than the maximum sales tax in AZ The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales.

Groceries and prescription drugs are exempt from the Arizona sales tax. This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona. The estimated 2022 sales tax rate for zip code 85718 is 610.

View more property details sales history and Zestimate data on Zillow. For a more detailed breakdown of rates please refer to. The Arizona sales tax rate is currently 56.

5450 E Craycroft Cir Tucson AZ 85718 775000 MLS 22224542 The perfect balance of luxurious foothills living and southwest. 4 beds 3 baths 3049 sq. For tax rates in other.

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. Get rates tables What is the sales tax rate for the 85718 ZIP Code. The estimated 2022 sales tax rate for.

This is the total of state county and city sales tax rates.

The Facts About Real Estate Tax In Arizona

7025 N Skyway Dr Tucson Az 85718 Mls 22209923 Redfin

Arizona S 30 Largest Cities And Towns Ranked For Local Taxes Kiplinger

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Arizona Sales Tax Rates By City County 2022

7025 N Skyway Dr Tucson Az 85718 Mls 22209923 Redfin

Solved I Struggled With The Automatic Sales Tax Setup Now I Can T Do My Classwork

Merchants Rio Nuevo Downtown Redevelopment And Revitalization District Tucson Az

Want To Retire In Arizona Here S What You Need To Know Vision Retirement

5101 N Via Entrada Tucson Az 85718 Realtor Com

How To Register For A Sales Tax Permit In Arizona Taxjar

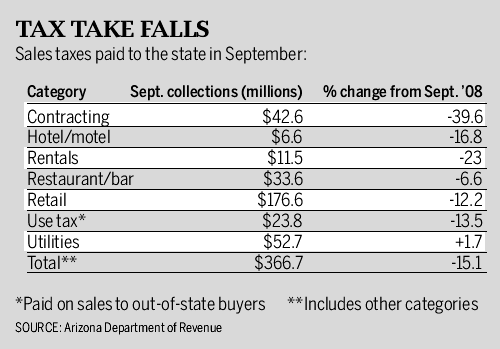

Az Sales Tax Take Fell 15 1 In Sept

Amazon Will Collect Sales Tax In Arizona On February 1 Avalara

National Register Of Historic Places Listings In Arizona Wikipedia

Combining Sales Tax Rates Experts In Quickbooks Consulting Quickbooks Training By Accountants

List Of 6 Arizona Tax Credits Christian Family Care

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

5 Things You Need To Know About Sales Taxes In Quickbooks Online Farkouh Furman Faccio Llp Certified Public Accountants Advisors

1 Arizona Sales Tax Use Tax Chunyan Pan Tax Manager Financial Services Office Ppt Download